Virginia, The Mother of States, has always been the home of a large number of brave men and women who have made immense sacrifices to protect America and uphold her values on the battlefield. According to the US Department of Veteran Affairs (VA), there are more than 7 hundred thousand veterans currently residing in the state of Virginia. If you are a veteran who wants to settle down in this state after separating from the service, then you are not alone. There are a large number of veterans who dream of settling down in this state by buying a home of their own. Now, if you don’t have the finances to buy a house of your own, then you can always get the benefits of the VA Loan Guaranty Program. Under this particular program of the Department of Veteran Affairs, eligible veterans and active duty soldiers can take a home loan from a lender and the guaranty of the loan would be provided by the VA.

There are many advantages of getting a loan under the guaranty program. For one thing, you don’t have to pay any down payments and the interest rate is also quite low. In most cases you don’t have to pay for Private Mortgage Insurance (PMI). Surely, all these advantages make getting a VA Loan (as these loans are often called) one of the easiest and the most convenient ways of fulfilling the dream of home ownership for veterans. Here we look at some of the things that you should be aware of, while applying for a VA Loan in Virginia.

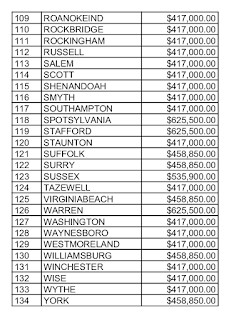

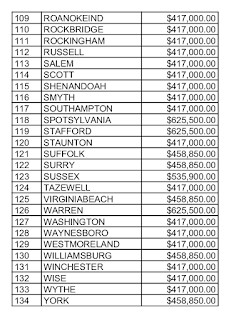

The concept of VA Loan limits refers to the maximum amount of loan that the VA would guarantee. This does not mean that it is the maximum amount you would be getting. There might be certain VA-approved lenders who would offer you a larger amount as a loan than the prescribed limit. The VA loan limits differ from county to county. The list of VA Loan Limits Virginia is given below.

There are many advantages of getting a loan under the guaranty program. For one thing, you don’t have to pay any down payments and the interest rate is also quite low. In most cases you don’t have to pay for Private Mortgage Insurance (PMI). Surely, all these advantages make getting a VA Loan (as these loans are often called) one of the easiest and the most convenient ways of fulfilling the dream of home ownership for veterans. Here we look at some of the things that you should be aware of, while applying for a VA Loan in Virginia.

Things You Can Use a VA Loan For

You can get a VA Loan for the following >- Buying a home

- Building a home

- Repairing, altering, or improving a home

- Buying a residential condominium

- Refinancing an existing home loan

- Buying and improving a manufactured home lot

- Buying a manufactured home with a lot or without a lot

- Purchasing a home and improving it simultaneously with energy-efficient improvements

- Installation of a solar heating or cooling system

- Refinancing a manufactured home loan to acquire a lot

- Refinancing an existing VA loan to reduce the interest rate and make energy-efficient improvements.

VA Loan Limits in Virginia

The concept of VA Loan limits refers to the maximum amount of loan that the VA would guarantee. This does not mean that it is the maximum amount you would be getting. There might be certain VA-approved lenders who would offer you a larger amount as a loan than the prescribed limit. The VA loan limits differ from county to county. The list of VA Loan Limits Virginia is given below.

EmoticonEmoticon